Problem #1

Severe shortage of Accountants

With an expected shortage of 53,000 accountants annually, firms are struggling with an increasing talent gap.

Problem #2

Outsourcing to 3rd

parties isn’t working!

Outsourcing to 3rd parties isn’t working!

Poor-quality talent pool due

to low salaries, weak

employer branding, and

inadequate cultural

integration with US firms,

impacting retention and

quality of work.

Firms need a transparent, scalable, and high-quality talent solution that addresses these challenges without compromising on standards.

The solution: your own GCC in India with Miles BOT model

The solution:

your own GCC in India with

Miles BOTT model

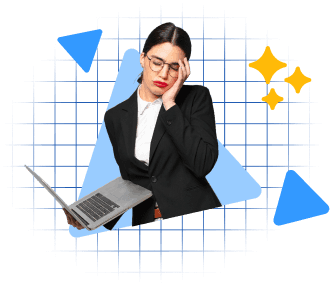

Build:

Miles builds your GCC in alignment with your requirements and integrates with your firm culture.

Operate:

Miles manages your GCC with an open-book commercial model, leveraging our brand to attract top talent and seamlessly integrating with your US office operations.

Transfer:

A smooth, efficient transition to your own fully owned Indian GCC which will essentially be your extended team

GCC Model vs 3rd party

outsourcing

GCC Model vs 3rd party outsourcing

Outsourcing to 3rd Parties

To reduce cost and maximize margins, often squeeze on salaries paid to talent affecting quality of talent pool.

Don't have an employer brand (unlike Big 4 / GCCs) and are unable to attract quality talent.

Operate as 3rd parties, and are unable to integrate with the culture of the US firms.

Your Own GCC (BOT by Miles)

With the cost+ model, you decide the pay. No compromise on quality of talent pool.

Leverage the Miles brand and its access to 1.2M+ accountants (70K alumni) for your initial team.

Operates as your extended office, ensuring seamless culture alignment and high employee retention.

Why choose Miles?

Proven expertise

- Proven success in scaling GCCs for Big 4 & mid-tier public accounting firms.

- Partner with Deloitte, EY, KPMG, PWC, RSM, GT, BDO and many others

Access to top talent

- Established brand in the Indian accounting community.

- Access to 1.2 MM accountants (Including 70,000+ alumni)

Complemented by Miles US STEM pathway

- Miles US STEM pathway allows Indian accountants to work in the U.S. for 3 years on W2.

- After 3 years, Miles US STEM pathway candidates can seamlessly join your India GCC

Open-book model for

100% transparency

Open-book model for 100% transparency

Cost

Salaries, benefits are decided by you. And overheads are clearly outlined.

+

Miles' management fee is a pre-agreed % of cost. No hidden margins or markups.

Implementation roadmap:

a phased approach

Implementation roadmap: a phased approach

Why outsource to 3rd parties? Build your GCC in India

Let's get started!

Miles Talent Hub Solution Suite

FAQs

1. Why should CPA firms consider setting up a GCC instead of outsourcing their accounting work?

A GCC allows firms to maintain control over operations and workforce while ensuring quality and cultural alignment. Unlike outsourcing, which often involves third-party management and hidden costs, a GCC offers transparency.

2. Why is data security important when establishing a GCC?

Data security is crucial as firms handle sensitive financial information. The BOT model emphasizes robust security measures that are compliant with international standards (e.g., SOC 2, GDPR).

3. Why is India considered a prime location for establishing a GCC?

India offers a vast pool of highly skilled accounting professionals, competitive labor costs, and familiarity with U.S. accounting standards.